Image courtesy of F&T Water Solutions

The trade off

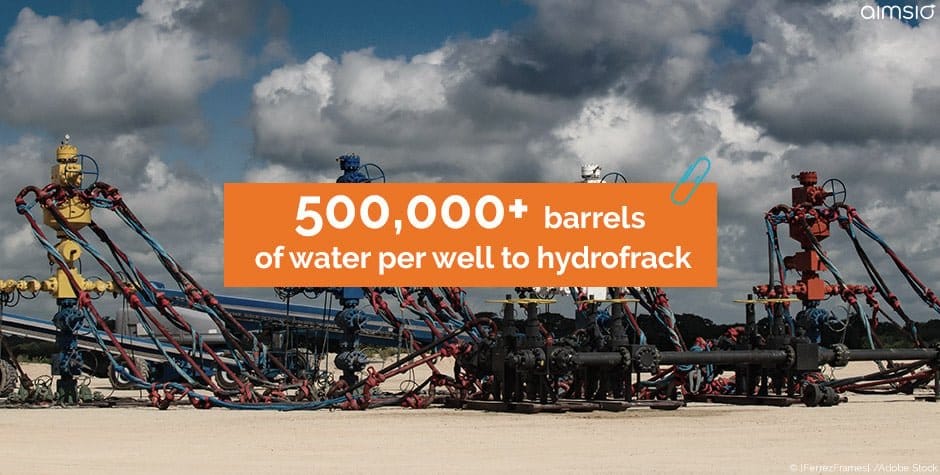

The newest, most efficient methods of oil and gas extraction require more water than conventional drilling. Fracking for oil and shale gas, along with SAGD to recover bitumen, have allowed operators to access challenging deposits while reducing their surface footprint. The gains in yield and sustainability come at the cost of another precious resource: water. For example, fracking in the Permian requires an average of 500,000 bbl of water per well, a number that can double depending on lateral length. Water can be a scarce resource and finding adequate supply is challenging in critical areas — a recent paper by ConocoPhillips found sourcing water in West Texas to be a serious issue.

Increased water usage is a double-edged sword. Once fracking is complete, operators have to dispose of more flowback water, estimated to have increased 300 percent since 2016 in the Permian Basin. Wastewater doesn’t end with flowback, either. Some wells produce as many as eleven barrels of water for every barrel of oil. A recent Bloomberg estimate puts daily wastewater (flowback and produced combined) production in the Permian at 30 to 50 million barrels.It has been suggested that failed water management could extinguish the roaring Permian Basin. Industry experts have modelled various scenarios of rising costs and increased restraints for operational water sourcing, transport, storage and disposal. In a report published early this year, the worst-case outcomes forecast an $3 to $6 per barrel increase in break-even cost in the Midland and Delaware sub-plays. This factor could curb growth in what has been called “the largest and most important source of oil growth in the world” (CNN) by 400,000 bpd by 2025.

SAGD: Early water management innovation

In the Alberta oil sands, produced water is a byproduct of the SAGD extraction process. Using steam to recover hydrocarbons is a relatively new technology compared to hydraulic fracturing, but the associated water recycling technology is more mature and widely adopted. Since 2014, GE Water (now Suez) has given producers the means to recover 97 percent of water used in bitumen extraction with their RCC evaporators. Oil sands heavyweight Cenovus developed technology that allows boiler blowdown to be reboiled without any treatment. This reduces the energy required to heat water for injection, as well as the demand on local aquifers for make-up water.

Why is water so hard to manage now?

Hydraulic fracturing has increased hydrocarbon recovery in areas such as the Permian Basin, which was once thought to be ‘overly mature’. However, the longer laterals that are increasing production require much more water in an area that experiences recurring drought conditions.

A recent study by Duke University found that water used per well for hydraulic fracturing increased 770 percent in all major U.S. shale gas and oil production regions between 2011 and 2016. Previous studies suggested that fracking did not use significantly more water than conventional drilling, but 2015 marked a turning point. Currently, the average well requires more than 21 million gallons of water for fracking, a number that will rise as laterals lengths increase.

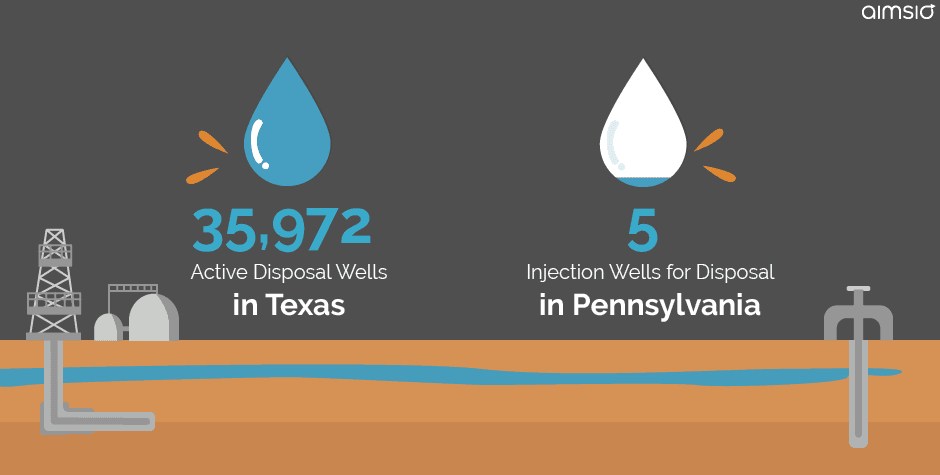

Disposal of wastewater in West Texas is not a question of where to dispose of it, but how to get it there. There are 35,972 active disposal wells in Texas as of May 2018 and the water disposal market is projected to reach 8.4 billion bbl by 2019. To put this number in perspective, Pennsylvania’s stringent permitting process has allowed only five injection wells for disposal across the entire state. Unfortunately, infrastructure insufficiencies means the tens of thousands of disposal sites aren’t necessarily convenient to get to by truck. Inadequate pipelines, narrow roads and a shortage of truck drivers make transport expensive and time consuming. According to Benjamin Stewart, VP of Shale Research for Rystad Energy, moving wastewater by truck is avoided whenever possible, “It’s expensive, it’s time-consuming, and with the issues we’re seeing here with traffic just on the proppant side of things, with the sheer volumes you’ve got, the last thing you want to do is add another cluster with a water truck.”

These challenges beg the question, why dispose of produced water at all?

Produced water management is an opportunity to recover resources.

Bridget Scanlon, senior research scientist at the University of Texas at Austin’s Bureau of Economic Geology recently reported that wells in the Delaware Basin are producing enough water to sustain fracking operations. Scanlon also states that the produced water “doesn’t require much treatment” before it can be used to frac.

Treatment is required, nonetheless. Mark Patton of water management company Hydrozonix notes that most operators are performing solids-separation in their gathering systems, but a secondary system is required to ensure compatibility with frac additives. There is no one-size-fits-all in terms of treatment of produced water for reuse as fracking fluid, either. Produced water composition differs between wells and even across the life of the same well, so regular testing and adjustments are necessary. If produced water exceeds the volume required for nearby fracking, treating to ‘zero liquid discharge’ results in water that can be used for agriculture or industrial applications.

Zero liquid discharge seems ideal, but it’s not always necessary. Innovative water treatment specialists Saltworks advise operators to consider treatment goals, economics and regulatory requirements when deciding how to treat produced water. Experienced water management partners are valuable allies that can formulate cost-effective, regulatory compliant solutions. They consider all variables, such as if the cost of heating an evaporator is prohibitive or if concentrating wastewater and trucking a lower volume of brine to disposal would have the best impact on the bottom line.

The produced water dilemma is an example of the ever-changing conditions that upstream oil and gas operators contend with. At Aimsio, we know what you’re up against. Our speciality is streamlining field operations and we work hard to be a valued ally to our clients.